Trust Foundations: Guaranteeing Longevity and Dependability

Trust Foundations: Guaranteeing Longevity and Dependability

Blog Article

Securing Your Assets: Depend On Foundation Expertise within your reaches

In today's complex financial landscape, guaranteeing the safety and development of your possessions is vital. Trust fund structures offer as a keystone for securing your wide range and tradition, supplying an organized technique to possession security.

Significance of Count On Foundations

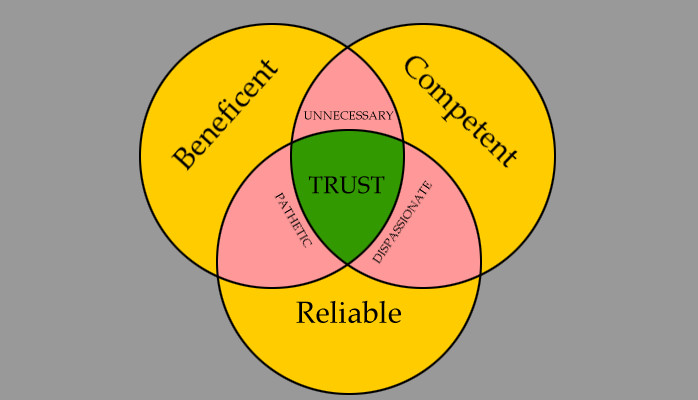

Count on foundations play a crucial role in developing reputation and cultivating solid partnerships in numerous specialist settings. Building trust is essential for organizations to grow, as it develops the basis of successful collaborations and collaborations. When depend on exists, individuals really feel a lot more positive in their interactions, bring about boosted efficiency and efficiency. Trust fund foundations function as the keystone for honest decision-making and transparent interaction within organizations. By focusing on depend on, businesses can develop a positive job society where employees really feel valued and respected.

Benefits of Specialist Support

Structure on the foundation of count on specialist relationships, seeking professional assistance provides vital advantages for people and companies alike. Specialist advice offers a wealth of understanding and experience that can help browse complex financial, lawful, or critical challenges easily. By leveraging the experience of specialists in various areas, individuals and companies can make enlightened decisions that line up with their goals and aspirations.

One substantial advantage of professional guidance is the capability to access specialized expertise that may not be readily offered or else. Experts can provide insights and point of views that can cause innovative remedies and opportunities for growth. Furthermore, working with professionals can aid alleviate risks and unpredictabilities by offering a clear roadmap for success.

Furthermore, specialist advice can save time and sources by streamlining processes and preventing costly errors. trust foundations. Specialists can use personalized recommendations customized to details needs, guaranteeing that every decision is educated and calculated. On the whole, the benefits of expert assistance are diverse, making it a useful possession in guarding and optimizing assets for the long-term

Ensuring Financial Protection

Making her response certain monetary safety includes a multifaceted approach that incorporates numerous elements of wealth management. By spreading out financial investments across various property classes, such as stocks, bonds, actual estate, and products, the risk of substantial economic loss can be reduced.

Additionally, keeping an emergency situation fund is helpful resources vital to safeguard versus unforeseen expenses or revenue interruptions. Experts advise setting apart three to 6 months' worth of living expenses in a fluid, easily obtainable account. This fund serves as a monetary safeguard, supplying satisfaction throughout rough times.

Regularly examining and adjusting economic plans in action to changing scenarios is also vital. Life events, market changes, and legal changes can influence financial stability, emphasizing the significance of continuous evaluation and adaptation in the search of long-term monetary protection - trust foundations. By executing these techniques attentively and consistently, individuals can strengthen their economic footing and work towards an extra secure future

Protecting Your Possessions Properly

With a solid foundation in place for financial security via diversity and emergency situation fund maintenance, the next crucial step is safeguarding your properties properly. One efficient method is possession allocation, which involves spreading your financial investments throughout various asset classes to minimize threat.

Furthermore, establishing a depend on can offer a safe way to secure your assets for future generations. Depends on can help you manage just how your assets are dispersed, minimize estate tax obligations, and shield your riches from financial institutions. By implementing these methods and looking for expert recommendations, you can safeguard your possessions properly and click for source secure your monetary future.

Long-Term Possession Defense

Lasting possession security involves implementing measures to guard your properties from numerous dangers such as economic downturns, lawsuits, or unanticipated life occasions. One crucial facet of long-term property security is establishing a trust, which can supply substantial advantages in shielding your properties from lenders and legal disagreements.

Additionally, diversifying your financial investment profile is another vital method for long-term property security. By spreading your investments throughout different property classes, industries, and geographical areas, you can reduce the influence of market changes on your total riches. Additionally, consistently examining and updating your estate plan is necessary to make sure that your assets are shielded according to your wishes in the lengthy run. By taking a proactive strategy to long-term property protection, you can secure your wide range and offer economic safety and security for on your own and future generations.

Conclusion

In verdict, trust fund structures play a critical function in securing possessions and making sure monetary safety and security. Professional assistance in establishing and managing trust fund frameworks is necessary for long-lasting possession security.

Report this page